401k fee comparison calculator

Get a quick quote using the calculator on the companys website and enjoy 14-day free look period during which time you can still get a full refund. 401k CRPA TM is a non-intrusive plan sponsor initiated fiduciary training and fee comparison tool.

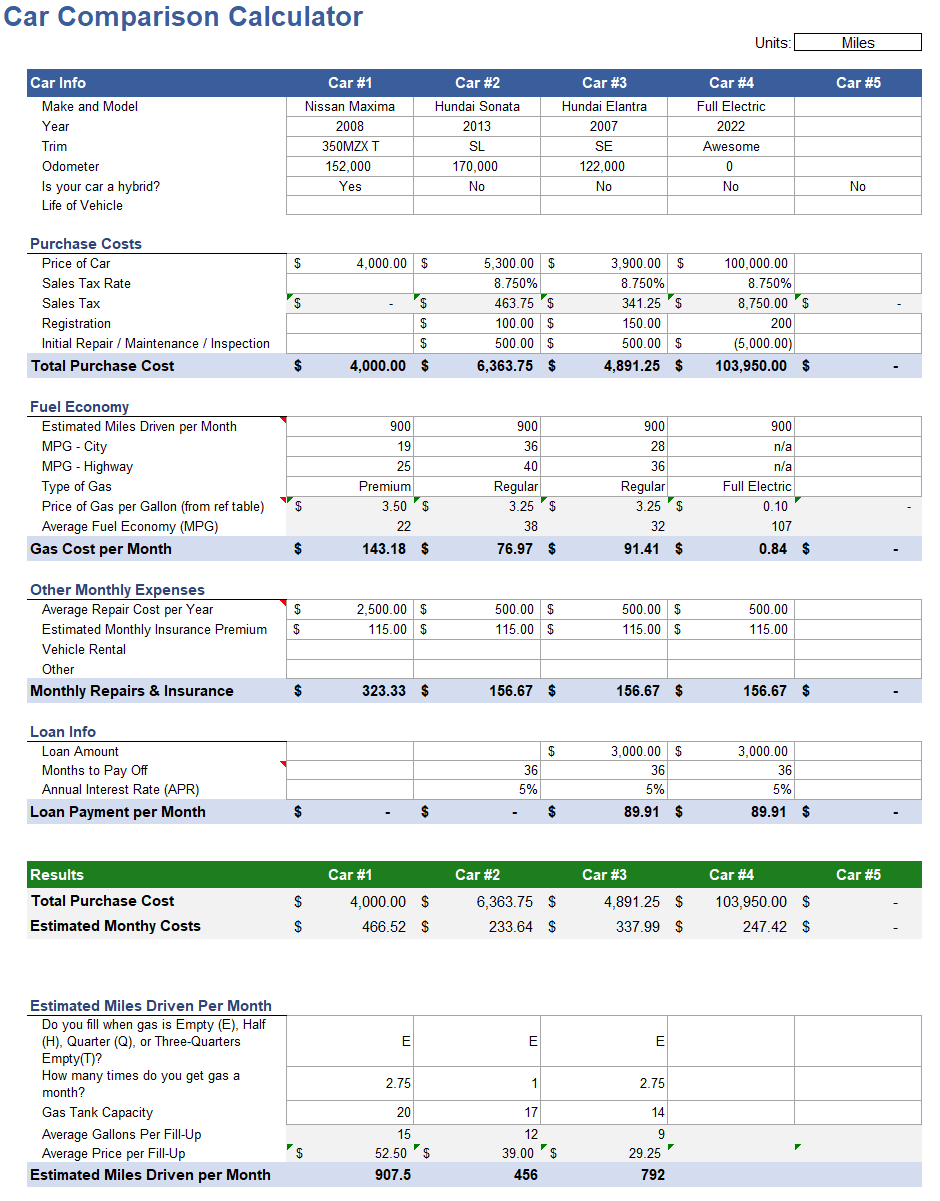

Car Comparison Calculator For Excel

401k CRPA is the perfect tool to help you develop relationships with plan sponsors.

. 80 Ways To Make Money From Home In 2022. They are all free. Calculator Estimate your 401k plan costs.

Use this 401k calculator to see where you are. A credit card with no annual fee may provide basic roadside assistance such as towing tire replacement and jump-starting a vehicle but a 450 annual fee card may additionally include fuel. A separate agreement is required for all Tax Audit Notice Services.

Neither Schwabs affiliate CSIM nor Schwab active semi-transparent ETFs pay a. As you review your quotes call us at 800-872-6684 with any. No account fees to open a Fidelity retail IRA.

Solo 401k Contribution Calculator. Contribution Comparison to estimate the potential contribution that can be made to a Solo 401k plan compared to Profit Sharing SIMPLE or SEP plan. Regarding reporting 401K rollover into IRA how you report it to the IRS depends on the type of rollover.

One way per person based on 2 people travelling on the same booking. Rollover IRA401K Rollover Options Combining 401Ks How to Rollover a 401K. Additional charges for baggage.

This fee will vary but typically is an asset-based fee of 010 per annum of the assets held at Schwab. Others imitate but as the 1 Solo 401k provider we innovate. For Android phonetablet iPhoneiPad and financial calculators on the web.

Generally taking money from a 401k before the age of 59 ½ would have a 10 penalty fee. 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account. You can use our IRA Contribution Calculator or our Roth vs.

If something does happen and you need to make a claim you can use the online portal call the toll-free. Roll Over IRA or 401k into Annuity. Not all financial institutions participate in electronic funding.

Locating and purchasing an IRA or 401k annuity is easy if you take advantage of this websites services. Amended tax returns not included in flat fees. One way per person based on 1 2 or 4 people travelling as indicated on the same booking.

While personal finance pros dont recommend raiding your retirement plan for cash if you can avoid it one major way to tap your 401k plan is through a 401k loan. 1500 or 200 a day. 401k Save the Max Calculator.

This article will help answer frequently asked questions about what happens to a 401k or other similar retirement accounts in the event of a divorce. You can withdraw it but you will pay an early surrender fee and other penalties. Setup Your Solo 401k Today.

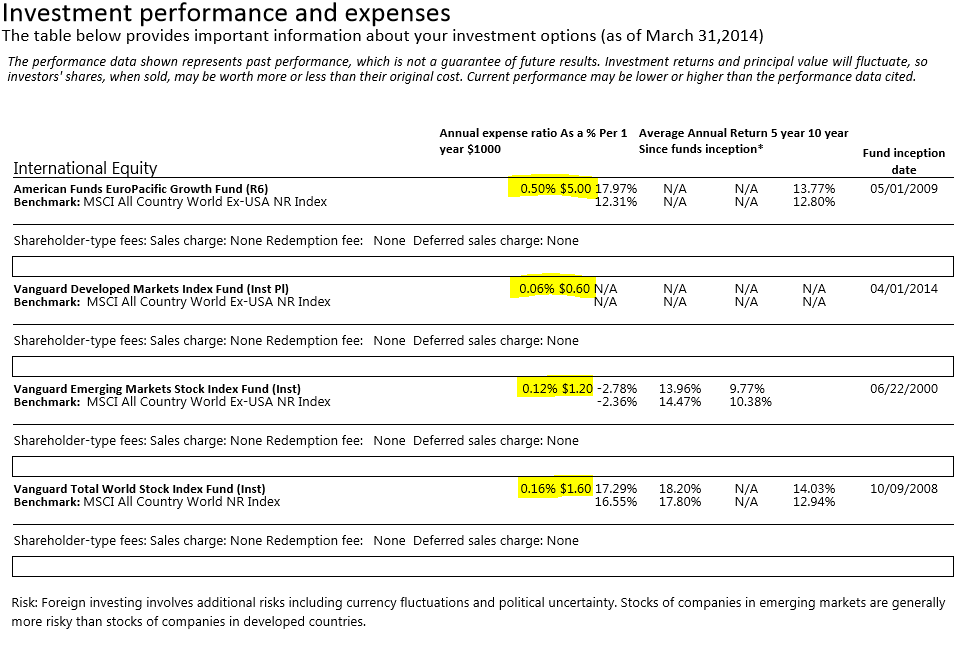

If you are unsure of your banks policy please consult your bank to determine if they will approve an electronic transfer of funds prior to using electronic funding. The Fidelity Go program advisory fee is calculated and charged at the account level. See a side-by-side comparison of our 401k plans.

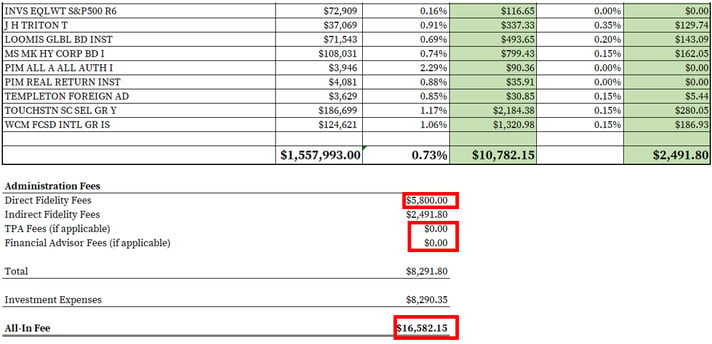

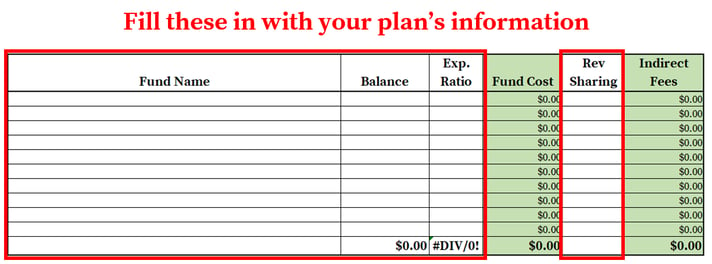

FIDUCIARY TRAINING PLAN SPONSORS CAN USE. By charging a 008 account fee we are able to remove transaction fees including but not limited to. Use this Solo 401k Contribution Comparison calculator to estimate the potential contribution that can be made to your Solo 401k plan by comparing it to Profit Sharing SIMPLE or SEP plans.

A 695 commission applies to trades of over-the-counter OTC stocks which. A 065 per contract fee applies for options trades. Regarding rolling 401K into IRA you should receive a Form 1099-R reporting your 401K distribution.

However early withdrawals can be made as part of a divorce settlement without this fee by. A Power of Attorney may be required for some Tax Audit Notice Services. Your first step is to use the calculators on our site to create a free instant annuity comparison report with the names and amounts offered by 10 leading insurance companies.

Traditional IRA comparison page to see what option might be right for you. 2021-2022 Tax Brackets and Federal Income Tax Rates. The fee is a percentage of the loan amount that varies from 0 to 36 depending on factors such as the down payment amount veterans military experience type of home and loan purpose.

Save on taxes and build for a bigger retirment. 401k Rollover to IRA. Consult your own attorney for legal advice.

Per year free initial consultation Account minimum. You can be a freelancer. Rollover fees distribution fees loan application fees loan maintenance fees QDRO fees check stop payment fees.

The highest immediate annuity quote is 633month versus. 15 Best Side Hustle Jobs You Can Start Earning With In 2022. Commercial Loan Calculator.

Comparison based on paper check mailed from the IRS. For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group. If this was a direct rollover it should be coded G.

Free credit card calculator to find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame. Mutual Fund Fee Calculator. Advisor introduced at no cost to the plan sponsor.

You may be charged an ACH Return Fee if your bank rejects an electronic funding transfer. Learn how with these tips. Retirement Savings Calculator.

Flight prices in external advertising. 2021-2022 Capital Gains Tax Rates and Calculator. While Fidelity Personalized Planning Advice is not currently designed for investors who are retired or within 3 years.

Includes admin fee airport taxes. 1000 at 200 per day. 100 Ways To Make Money In College.

Tax Audit Notice Services include tax advice only. Traditional IRA vs. Includes admin fee airport taxes.

Find out how much you can contribute to your Solo 401k with our free contribution calculator. I am sending you a detailed comparison of these two options. A VA funding fee is a one-time payment that borrowers typically pay as part of acquiring a VA loan.

As an investor-owner you own the funds that own Vanguard. Enter the amount from your 1099-R Box 1 on Form 1040 Line 16a. 53 Side Hustle Ideas To Make Money Fast.

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

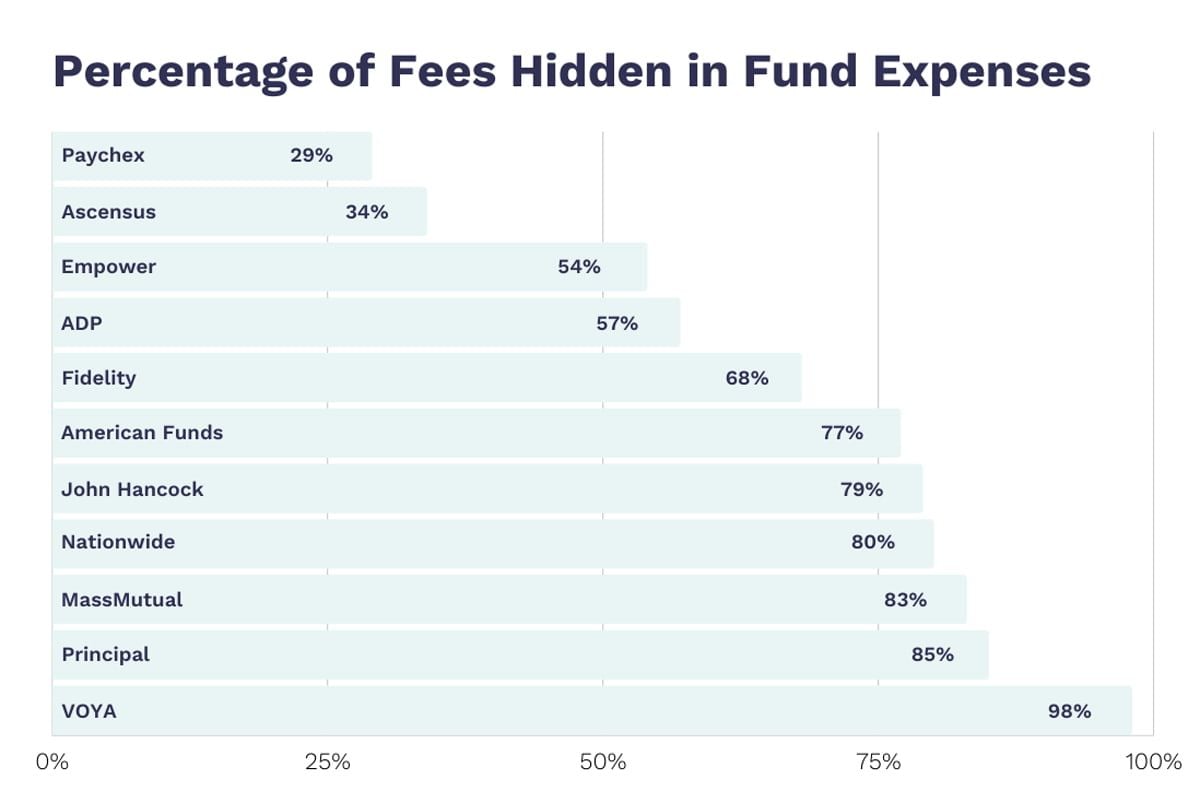

401 K Fees Calculator Cost Comparison Tool Forusall

/GettyImages-1145107751-48565b346773455eb6fe27c5be3df325.jpg)

Top 10 Small Business 401 K Plan Providers

Free 401k Calculator For Excel Calculate Your 401k Savings

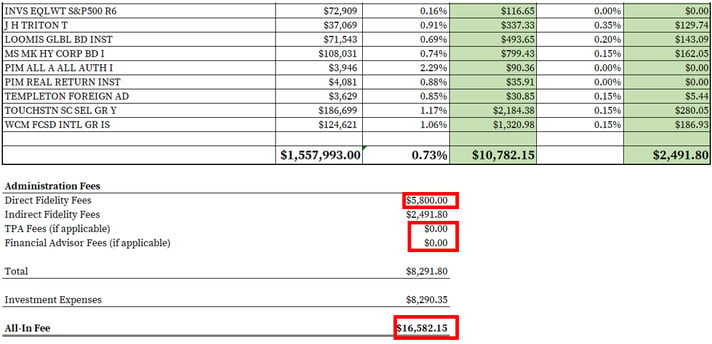

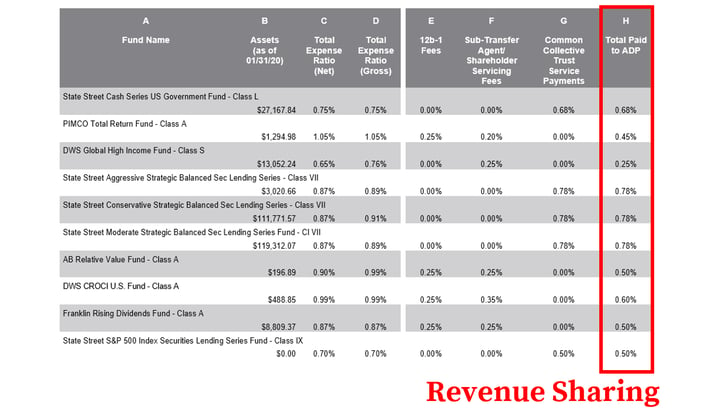

How To Find Calculate Adp 401 K Fees

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Find Calculate Your 401 K Fees

Free 401k Calculator For Excel Calculate Your 401k Savings

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Customizable 401k Calculator And Retirement Analysis Template

How To Calculate Your All In 401 K Fee

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Fee Calculator Blooom

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Paychex 401 K Fees

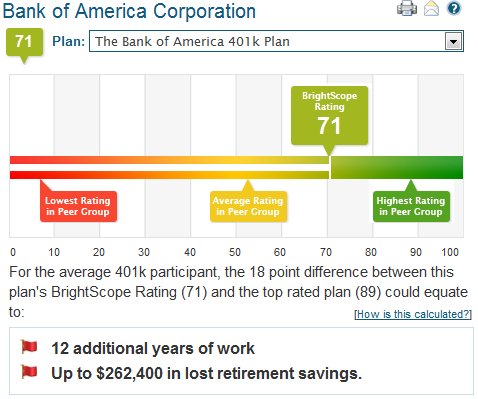

Brightscope 401k Review 2022 How Good Is Your 401k Part Time Money

Solo 401k Contribution Limits And Types